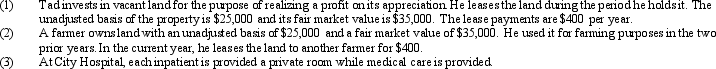

Consider the following three statements:  In which of the three cases above could the rental activity automatically be considered a passive activity?

In which of the three cases above could the rental activity automatically be considered a passive activity?

A) Case 1 only.

B) Case 2 only.

C) Case 3 only.

D) Cases 1,2,and 3.

E) None of the above.

Correct Answer:

Verified

Q69: Rita earns a salary of $150,000,and invests

Q73: Hugh has four passive activities.The following income

Q74: In 2010,Jean earns a salary of $150,000

Q75: In 2009,Kelly,who earns a salary of $200,000,invests

Q79: Rachel acquired a passive activity several years

Q80: Ramon incurs $55,400 of interest expense this

Q81: Joyce, an attorney, earns $100,000 from her

Q81: Explain how a taxpayer's at-risk amount in

Q82: During the current year,Ryan performs personal services

Q93: What special passive loss treatment is available

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents