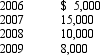

Molly has generated general business credits over the years that have not been utilized.The amounts generated and not utilized follow:  In the current year,2010,her business generates an additional $30,000 general business credit.In 2010,based on her tax liability before credits,she can utilize a general business credit of up to $40,000.After utilizing the carryforwards and the current year credits,how much of the general business credit generated in 2010 is available for future years?

In the current year,2010,her business generates an additional $30,000 general business credit.In 2010,based on her tax liability before credits,she can utilize a general business credit of up to $40,000.After utilizing the carryforwards and the current year credits,how much of the general business credit generated in 2010 is available for future years?

A) $0.

B) $2,000.

C) $23,000.

D) $28,000.

E) None of the above.

Correct Answer:

Verified

Q24: The education tax credits (i.e., the American

Q27: Child and dependent care expenses include amounts

Q53: Only self-employed individuals are required to make

Q62: During the year,Tulip,Inc. ,incurs the following research

Q64: In March 2010,Gray Corporation hired two individuals,both

Q67: Green Company, in the renovation of its

Q73: Which of the following best describes the

Q78: Which, if any, of the following correctly

Q79: Refundable tax credits include the:

A)Foreign tax credit.

B)Tax

Q80: During the year, Purple Corporation (a U.S.Corporation)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents