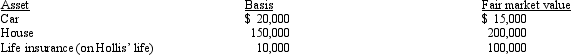

Henrietta and Hollis have been married for 10 years when Hollis dies in a sky-diving accident.Their assets are summarized below.  Henrietta and Hollis reside in Wisconsin,a community property state.All of the assets were acquired with community funds and pass to Henrietta.Her basis for each of the assets becomes:

Henrietta and Hollis reside in Wisconsin,a community property state.All of the assets were acquired with community funds and pass to Henrietta.Her basis for each of the assets becomes:

Car House Cash from life insurance proceeds

A) $20,000 $150,000 $ 10,000

B) $17,500 $175,000 $ 10,000

C) $17,500 $175,000 $100,000

D) $15,000 $200,000 $100,000

E) None of the above.

Correct Answer:

Verified

Q141: Lynn purchases a house for $52,000. She

Q144: Latisha owns a warehouse with an adjusted

Q145: Which of the following statements is correct?

A)

Q148: Taylor inherited 100 acres of land on

Q150: In order to qualify for like-kind exchange

Q152: Andrew acquires 2,000 shares of Eagle Corporation

Q152: Iva owns Mauve, Inc.stock (adjusted basis of

Q155: Kahil exchanges a drill press that is

Q157: If personal use property is converted to

Q158: Robert and Diane,husband and wife,live in Pennsylvania,a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents