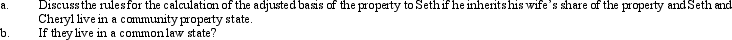

Seth and Cheryl,husband and wife,own property jointly.The property has an adjusted basis of $25,000 and a fair market value of $30,000.

Correct Answer:

Verified

Q37: What is the general formula for calculating

Q38: Don,who is single,sells his personal residence on

Q39: For the following exchanges,indicate which qualify as

Q40: Samuel's hotel is condemned by the City

Q62: Mitchell owned an SUV that he had

Q74: Alice is terminally ill and does not

Q204: If a taxpayer purchases a business and

Q206: If a taxpayer purchases taxable bonds at

Q222: Discuss the application of holding period rules

Q232: Explain how the sale of investment property

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents