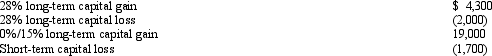

Harold is a head of household,has $27,000 of taxable income in 2010 from non-capital gain or loss sources,and has the following capital gains and losses:

What is Harold's taxable income and the tax on that taxable income?

What is Harold's taxable income and the tax on that taxable income?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q109: An individual has a $10,000 § 1245

Q110: Kari owns depreciable residential rental real estate

Q111: Bakra was the holder of a patent

Q112: Phil's father died on January 10,2010.The father

Q115: Assume a building is subject to §

Q115: Septa is the owner of vacant land

Q116: On January 18,2009,Martha purchased 200 shares of

Q117: A retail building used in the business

Q118: The chart below details Sheen's 2008,2009,and 2010

Q119: Ulma had the following transactions during 2010:

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents