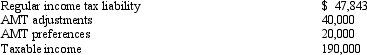

Meg,who is single and age 36,provides you with the following information from her financial records.  Calculate her AMT exemption for 2010.

Calculate her AMT exemption for 2010.

A) $1,143.

B) $27,325.

C) $46,700.

D) $47,843.

E) None of the above.

Correct Answer:

Verified

Q37: The exercise of an incentive stock option

Q38: Medical expenses are reduced by 10% of

Q39: Frances,who had AGI of $100,000,itemized her deductions

Q41: In 2010 and under § 1202,Jordan excludes

Q42: The AMT exemption for C corporations is

Q45: As to the AMT,a C corporation has

Q48: Corporations are subject to a positive AMT

Q51: For regular income tax purposes, Yolanda, who

Q51: For individual taxpayers, the AMT credit is

Q59: The AMT does not apply to qualifying

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents