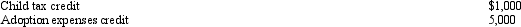

Prior to the effect of the tax credits,Justin's regular income tax liability is $200,000 and his tentative AMT is $195,000.Justin has the following credits:  Calculate Justin's tax liability after credits.

Calculate Justin's tax liability after credits.

A) $190,000.

B) $194,000.

C) $195,000.

D) $200,000.

E) None of the above.

Correct Answer:

Verified

Q49: During its first year of operations,Sherry's business

Q50: All of a corporation's AMT is available

Q51: Agnes is able to reduce her regular

Q52: If a single taxpayer has regular income

Q53: The C corporation AMT rate is higher

Q54: Interest income on private activity bonds issued

Q55: Miriam,who is single and age 36,provides you

Q56: Which of the following statements is correct?

A)The

Q57: If a taxpayer has tentative AMT of

Q59: Kay had percentage depletion of $82,000 for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents