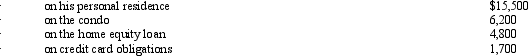

Ted,who is single,owns a personal residence in the city.He also owns a condo near the ocean.He uses the condo as a vacation home.In March 2010,he borrowed $50,000 on a home equity loan and used the proceeds to acquire a luxury automobile.During 2010,he paid the following amounts of interest:  What amount,if any,must Ted recognize as an AMT adjustment in 2010?

What amount,if any,must Ted recognize as an AMT adjustment in 2010?

A) $0.

B) $4,800.

C) $6,200.

D) $11,000.

E) None of the above.

Correct Answer:

Verified

Q45: If the taxpayer elects to capitalize intangible

Q59: Kay had percentage depletion of $82,000 for

Q61: Mitch,who is single and has no dependents,had

Q62: On January 3,1997,White Corporation acquired an office

Q63: Which of the following normally produces positive

Q65: Omar acquires used 7-year personal property for

Q66: Marvin,the vice president of Lavender,Inc. ,exercises stock

Q67: In 2010,Ray incurs $60,000 of mining exploration

Q68: Which of the following itemized deductions will

Q69: Prior to the effect of tax credits,Eunice's

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents