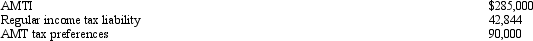

Caroline and Clint are married,have no dependents,and file a joint return in 2010.Use the following selected data to calculate their Federal income tax liability.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q86: Kay,who is single,had taxable income of $0

Q87: Green Corporation,a calendar year taxpayer,has alternative minimum

Q88: Smoke,Inc. ,provides you with the following information:

Q89: In September,Dorothy purchases a building for $900,000

Q90: Sage,Inc. ,has the following gross receipts and

Q92: In 2010,Olive incurs circulation expenses of $150,000

Q93: Lavender,Inc. ,incurs research and experimental expenditures of

Q95: Use the following selected data to calculate

Q96: Cindy,who is single and has no dependents,has

Q110: What is the relationship between taxable income

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents