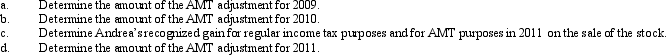

In May 2009,Egret,Inc.issues options to Andrea,a corporate officer,to purchase 200 shares of Egret stock under an ISO plan.At the date the stock options are issued,the fair market value of the stock is $900 per share and the option price is $1,200 per share.The stock becomes freely transferable in 2010.Andrea exercises the options in November 2009 when the stock is selling for $1,600 per share.She sells the stock in December 2011 for $1,800 per share.

Correct Answer:

Verified

Q91: Why is there no AMT adjustment for

Q95: Use the following selected data to calculate

Q96: Cindy,who is single and has no dependents,has

Q97: Calculate the AMT exemption for 2010 if

Q98: Mauve,Inc. ,has the following for 2009,2010,and 2011

Q98: If a taxpayer deducts the standard deduction

Q99: Tyson sells land and building whose adjusted

Q103: Mabel is in the 28% marginal tax

Q112: What is the relationship between the regular

Q126: Are the AMT rates for the individual

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents