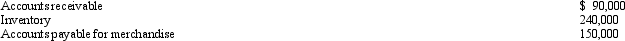

At the beginning of 2010,the taxpayer voluntarily changed from the cash to the accrual method of accounting.The relevant account balances as of January 1,2010,were as follows:

A) The company has a positive adjustment to income of $240,000 that must be recognized in 2010.

B) The company has a positive adjustment to income of $180,000 that can be allocated equally to years 2010-2013.

C) The company has a positive adjustment to income that can be allocated as follows: $47,500 to 2010 income,and $47,500 to each year's income,2011-2013.

D) No adjustment is required,but the company cannot use the cash method to report income and expenses for 2010.

E) None of the above.

Correct Answer:

Verified

Q41: Pink Corporation is an accrual basis taxpayer

Q42: Gray Company,a calendar year taxpayer,allows customers to

Q42: Which of the following statements regarding the

Q43: Abby sold her unincorporated business which consisted

Q44: Ivory Fast Delivery Company,an accrual basis taxpayer,frequently

Q45: Todd,a CPA,sold land for $200,000 plus a

Q47: When the IRS requires a taxpayer to

Q48: Generally,deductions for additions to reserves for estimated

Q49: The accrual basis taxpayer sold land for

Q51: The installment method applies to which of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents