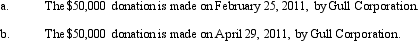

On December 30,2010,the board of directors of Gull Corporation,a calendar year,accrual method C corporation,authorized a contribution of $50,000 to a qualified charitable organization.For purposes of the taxable income limitation applicable to charitable deductions,Gull has taxable income of $420,000 and $370,000 for 2010 and 2011,respectively.Describe the tax consequences to Gull Corporation under the following independent situations.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q93: Heron Corporation,a calendar year,accrual basis taxpayer,provides the

Q94: Ostrich,a C corporation,has a net short-term capital

Q95: During the current year,Flamingo Corporation,a regular corporation

Q97: Schedule M-1 of Form 1120 is used

Q100: Warbler Corporation,an accrual method regular corporation,was formed

Q101: C corporations can elect fiscal years that

Q103: To close perceived tax loopholes,Congress enacted two

Q106: Describe the Federal tax treatment of entities

Q113: Shareholders of closely held C corporations frequently

Q129: Briefly describe the accounting methods available for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents