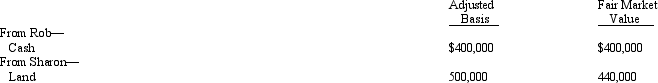

Rob and Sharon form Swallow Corporation with the following consideration:  Each receives 50% of Swallow's stock.In addition,Sharon receives cash of $40,000.One result of these transfers is that Sharon has a:

Each receives 50% of Swallow's stock.In addition,Sharon receives cash of $40,000.One result of these transfers is that Sharon has a:

A) Recognized loss of $60,000.

B) Recognized loss of $20,000.

C) Basis of $460,000 in the Swallow stock (assuming Swallow reduces its basis in the land to $440,000) .

D) Basis of $400,000 in the Swallow stock (assuming Swallow reduces its basis in the land to $440,000) .

E) None of the above.

Correct Answer:

Verified

Q41: Jane and Walt form Yellow Corporation.Jane transfers

Q42: Eileen transfers property worth $200,000 (basis of

Q43: Ira,a calendar year taxpayer,purchases as an investment

Q44: Ann,Irene,and Bob incorporate their respective businesses and

Q47: Kim owns 100% of the stock of

Q49: Sarah and Emily form Red Corporation with

Q49: Ronald,a cash basis taxpayer,incorporates his sole proprietorship.He

Q56: Amy owns 20% of the stock of

Q56: Sarah and Tony (mother and son) form

Q67: Wade and Paul form Swan Corporation with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents