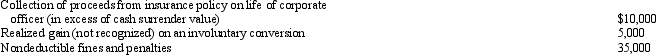

Red Corporation,a calendar year taxpayer,has taxable income of $600,000.Among its transactions for the year are the following:  Disregarding any provision for Federal income taxes,Red Corporation's current E & P is:

Disregarding any provision for Federal income taxes,Red Corporation's current E & P is:

A) $565,000.

B) $575,000.

C) $580,000.

D) $650,000.

E) None of the above.

Correct Answer:

Verified

Q1: Noncorporate shareholders generally prefer a nonqualified stock

Q8: For a stock redemption to qualify for

Q14: In a redemption to pay death taxes,

Q19: Reginald and Roland (Reginald's son) each own

Q42: The tax treatment of corporate distributions at

Q43: Bluebird Corporation's 1,000 shares outstanding are owned

Q45: Grackle Corporation (E & P of $900,000)distributes

Q46: Blue Corporation, a cash basis taxpayer, has

Q49: In applying the stock attribution rules to

Q51: Betty's adjusted gross estate is $7 million.The

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents