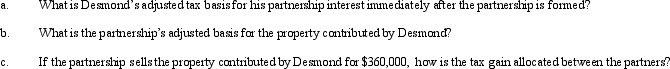

Joel and Desmond are forming the JD Partnership.Joel contributes $300,000 cash and Desmond contributes nondepreciable property with an adjusted basis of $80,000 and a fair market value of $330,000.The property is subject to a $30,000 liability,which is also transferred into the partnership and is shared equally by the partners for basis purposes.Joel and Desmond share in all partnership profits equally except for any precontribution gain,which must be allocated according to the statutory rules for built-in gain allocations.

Correct Answer:

Verified

Q76: In a proportionate liquidating distribution, Scott receives

Q83: The LN partnership reported the following items

Q128: Adam contributes property with a fair market

Q129: During the current year,ALF Partnership reported the

Q130: Which of the following statements correctly reflects

Q131: Denise invested $30,000 this year to purchase

Q134: Which of the following statements,if any,about an

Q135: Which of the following is not typically

Q136: Which of the following statements about the

Q137: Paul is a 25% owner in the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents