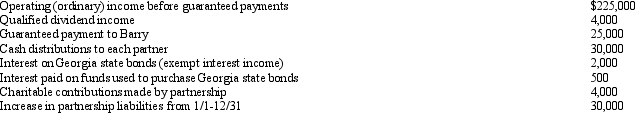

An examination of the RB Partnership's tax books provides the following information for the current year:

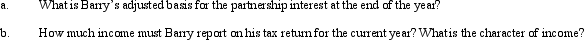

Barry is a 30% partner in partnership capital,profits,and losses.Assume the adjusted basis of his partnership interest is $50,000 at the beginning of the year,and he shares in 30% of the partnership liabilities for basis purposes.

Barry is a 30% partner in partnership capital,profits,and losses.Assume the adjusted basis of his partnership interest is $50,000 at the beginning of the year,and he shares in 30% of the partnership liabilities for basis purposes.

Correct Answer:

Verified

Q56: Jamie owns a 40% interest in the

Q64: In a proportionate liquidating distribution, Lina receives

Q65: Which of the following statements is true

Q76: In a proportionate liquidating distribution, Scott receives

Q117: Catherine's basis was $50,000 in the CAR

Q118: Carl receives a proportionate nonliquidating distribution when

Q119: Francine receives a proportionate liquidating distribution when

Q120: Barry owns a 25% interest in a

Q123: Barney,Bob,and Billie are equal partners in the

Q126: Roxanne contributes land to the newly formed

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents