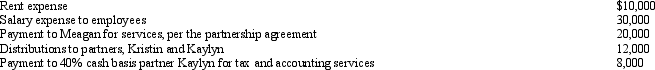

Meagan is a 40% general partner in the calendar year,cash basis MKK Partnership.The partnership received $100,000 income from services and paid the following other amounts:

How much will Meagan's adjusted gross income increase as a result of the above items?

How much will Meagan's adjusted gross income increase as a result of the above items?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q87: Jamie contributed fully depreciated ($0 basis) property

Q139: Which of the following is not true

Q140: Tina sells her 1/3 interest in the

Q141: Harry and Sally are considering forming a

Q141: The MOP Partnership is involved in leasing

Q143: Joe has a 25% capital and profits

Q145: Cindy is a 5% limited partner in

Q147: The MOG Partnership reports ordinary income of

Q148: Sharon and Sara are equal partners in

Q149: In the current year,the CAR Partnership received

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents