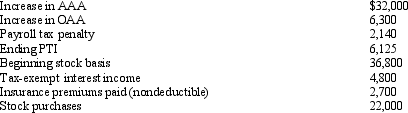

You are given the following facts about a 50% owner of an S corporation,and you are asked to prepare her ending stock basis.

A) $77,950.

B) $82,750.

C) $97,100.

D) $103,225.

Correct Answer:

Verified

Q84: Apple,Inc. ,a cash basis S corporation in

Q85: Excess net passive income of an S

Q86: Pepper,Inc. ,an S corporation in Norfolk,Virginia,has revenues

Q87: On January 1,Bobby and Alice own equally

Q88: An S corporation in Lawrence,Kansas has a

Q90: Samantha owned 1,000 shares in Evita,Inc. ,an

Q91: A C corporation elects S status.The corporation

Q93: Lott Corporation in Macon,Georgia converts to S

Q94: You are given the following facts about

Q113: A cash basis calendar year C corporation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents