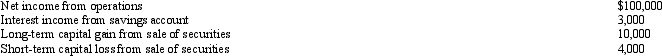

During 2010,Lion Corporation incurs the following transactions.  Lion maintains a valid S election and does not distribute any assets (cash or property) to its sole shareholder,Penny.As a result,Penny must recognize:

Lion maintains a valid S election and does not distribute any assets (cash or property) to its sole shareholder,Penny.As a result,Penny must recognize:

A) Ordinary income of $103,000 and long-term capital gain of $5,000.

B) Ordinary income of $103,000,long-term capital gain of $10,000,and $4,000 short-term capital loss.

C) Ordinary income of $108,000.

D) None of the above.

Correct Answer:

Verified

Q78: If the beginning balance in OAA is

Q79: Which equity arrangement would stop a corporation

Q80: Which transaction affects the Other Adjustments Account

Q81: Which statement is false?

A)An S corporation is

Q82: On January 2,2009,David loans his S corporation

Q84: Apple,Inc. ,a cash basis S corporation in

Q85: Excess net passive income of an S

Q86: Pepper,Inc. ,an S corporation in Norfolk,Virginia,has revenues

Q87: On January 1,Bobby and Alice own equally

Q88: An S corporation in Lawrence,Kansas has a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents