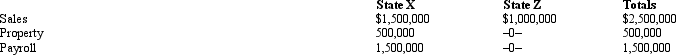

José Corporation realized $600,000 taxable income from the sales of its products in States X and Z.José's activities in both states establish nexus for income tax purposes.José's sales,payroll,and property among the states include the following.  Z utilizes a double-weighted sales factor in its three-factor apportionment formula.How much of José's taxable income is apportioned to Z?

Z utilizes a double-weighted sales factor in its three-factor apportionment formula.How much of José's taxable income is apportioned to Z?

A) $1,000,000.

B) $600,000.

C) $120,000.

D) $80,000.

E) $0.

Correct Answer:

Verified

Q55: José Corporation realized $600,000 taxable income from

Q57: Perez Corporation is subject to tax only

Q58: Mandy Corporation realized $1,000,000 taxable income from

Q59: The typical state sales/use tax falls on

Q59: Under P.L. 86-272, which of the following

Q62: Judy,a regional sales manager,has her office in

Q63: In determining taxable income for state income

Q65: In the broadest application of the unitary

Q89: Parent and Junior form a non-unitary group

Q95: A state sales tax usually falls upon:

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents