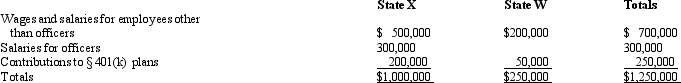

Trayne Corporation's sales office and manufacturing plant are located in State X.Trayne also maintains a manufacturing plant and sales office in State W.For purposes of apportionment,X defines payroll as all compensation paid to employees,including elective contributions to § 401(k) deferred compensation plans.Under the statutes of W,neither compensation paid to officers nor contributions to § 401(k) plans are included in the payroll factor.Trayne incurred the following personnel costs.  Trayne's payroll factor for State X is:

Trayne's payroll factor for State X is:

A) 100.00%.

B) 80.00%.

C) 73.68%.

D) 71.43%.

E) 50.00%.

Correct Answer:

Verified

Q67: In determining taxable income for state income

Q70: A use tax:

A)Applies when a State A

Q73: A taxpayer wishing to reduce the negative

Q75: Net Corporation's sales office and manufacturing plant

Q76: State D has adopted the principles of

Q77: In conducting multistate tax planning,the taxpayer should:

A)Review

Q84: A state sales tax usually falls upon:

A)

Q97: For most taxpayers, which of the traditional

Q101: Parent and Junior form a unitary group

Q108: When the taxpayer operates in one or

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents