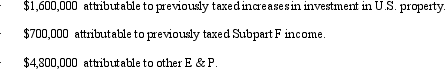

\Benchmark,Inc. ,a U.S.shareholder owns 100% of a CFC from which Benchmark receives a $3 million cash distribution.The CFC's E & P is composed of the following amounts.  Benchmark recognizes a taxable dividend of:

Benchmark recognizes a taxable dividend of:

A) $3 million.

B) $700,000.

C) $2,300,000.

D) $0.

Correct Answer:

Verified

Q63: Which of the following is a true

Q64: A controlled foreign corporation (CFC)realizes Subpart F

Q65: The green card remains in effect until:

A)The

Q65: In which of the following independent situations

Q66: Rufus,Inc. ,a domestic corporation,has worldwide taxable income

Q67: The following persons own Good Corporation,a foreign

Q69: ForCo,a controlled foreign corporation owned 100% by

Q70: USCo,a domestic corporation,receives $100,000 of foreign-source income

Q71: Which of the following income items do

Q72: Copp,Inc. ,a domestic corporation,owns 40% of a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents