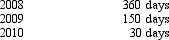

Shannon,a foreign person with a green card,spends the following days in the United States.  Shannon's residency status for 2010 is:

Shannon's residency status for 2010 is:

A) U.S.resident since she was a U.S.resident for the past immediately preceding two years.

B) U.S.resident because she has a green card.

C) Not a U.S.resident because Shannon was not in the United states for at least 31 days during 2010.

D) Not a U.S.resident since,using the three-year test,Shannon is not present in the United states for at least 183 days.

Correct Answer:

Verified

Q74: Which of the following is not a

Q86: The following income of a foreign corporation

Q88: Hickman, Inc., a U.S. corporation, operates an

Q88: Miles,Ltd. ,a foreign corporation,has a U.S.branch that

Q89: Which of the following statements regarding the

Q90: Which of the following transactions,if entered into

Q91: Wallack,Inc. ,a U.S.corporation,owns 100% of Orion,Ltd. ,a

Q97: A U.S.corporation may be able to alleviate

Q98: Performance,Inc. ,a U.S.corporation,owns 100% of Krumb,Ltd. ,a

Q106: Which of the following statements regarding a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents