Madison is a citizen of Italy and does not have permanent resident status in the United States.During the last three years she has spent a number of days in the United States.  Is Madison treated as a U.S.resident for the current year?

Is Madison treated as a U.S.resident for the current year?

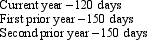

A) Yes,because Madison was present in the United States at least 31 days during the current year and 195 days during the current and prior two years (using the appropriate fractions for the prior years) .

B) No,because although Madison was present in the United States at least 31 days during the current year,she was not present at least 183 days in a single year during the current or prior two years.

C) No,because Madison is a citizen of Italy.

D) No,because Madison was not present at least 183 days during the current year.

Correct Answer:

Verified

Q98: Performance,Inc. ,a U.S.corporation,owns 100% of Krumb,Ltd. ,a

Q99: Mark,Inc. ,a U.S.corporation,operates an unincorporated branch manufacturing

Q100: ForCo,a foreign corporation not engaged in a

Q100: GlobalCo, a foreign corporation not engaged in

Q101: Which of the following determinations does not

Q102: Which of the following persons are typically

Q114: Which of the following statements regarding income

Q115: ForCo, a foreign corporation, receives interest income

Q122: Which of the following statements regarding the

Q138: Which of the following statements regarding the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents