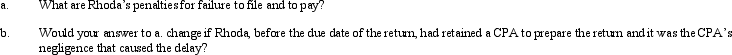

Rhoda,a calendar year individual taxpayer,files her 2008 return on February 20,2010.She had obtained a six-month extension for filing her return.There was additional income tax of $20,000 due with the return.

Correct Answer:

Verified

Q103: A CPA and a taxpayer can keep

Q104: Isaiah filed his Federal income tax return

Q105: Kim underpaid her taxes by $30,000.Of this

Q106: Carol's AGI last year was $180,000.Her Federal

Q107: Orville,a cash basis,calendar year taxpayer,filed his income

Q109: Yin-Li is the preparer of the Form

Q110: The tax preparer penalty for taking an

Q111: Why should the tax practitioner study the

Q112: Dana underpaid his taxes by $150,000.Portions of

Q113: Purple Ltd. ,a calendar year taxpayer,had the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents