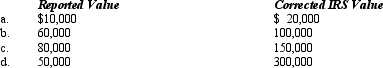

Compute the undervaluation penalty for each of the following independent cases involving the executor's reporting of the value of a closely held business in the decedent's gross estate.In each case,assume a marginal estate tax rate of 45%.

Correct Answer:

Verified

Q108: The Code's scope of privileged communications for

Q116: Compute the failure to pay and failure

Q117: Orange Ltd.withheld from its employees' paychecks $300,000

Q121: Describe how the IRS applies interest rules

Q123: What taxpayer penalties can arise when a

Q124: Arnold made a charitable contribution of property

Q124: Identify a profile for a taxpayer who

Q139: A(n) _ member is required to follow

Q164: In connection with the taxpayer penalty for

Q173: Circular 230 requires that the tax practitioner

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents