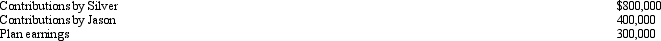

At the time of his death,Jason was a participant in Silver Corporation's qualified pension plan and group term life insurance.The balance in his pension plan is:  The term insurance has a maturity value of $100,000.All amounts are paid to Pam,Jason's daughter.One result of these transactions is:

The term insurance has a maturity value of $100,000.All amounts are paid to Pam,Jason's daughter.One result of these transactions is:

A) Pam must pay income tax on $300,000.

B) Pam must pay income tax on $1,100,000.

C) Jason's gross estate must include $1,100,000.

D) Jason's gross estate must include $1,500,000.

E) None of the above.

Correct Answer:

Verified

Q90: In which of the following situations is

Q90: Which, if any, of the following statements

Q91: In which of the following situations has

Q92: In which,if any,of the following independent situations

Q93: At the time of his death,Norton was

Q95: At the time of her death on

Q96: Martha inherits unimproved land (fair market value

Q97: Before his nephew (Dean)leaves for college,Will loans

Q98: Which,if any,of the following items is subject

Q99: In which,if any,of the following independent situations

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents