Townson Company had gross wages of $200,000 during the week ended December 10.The amount of wages subject to social security tax was $180,000,while the amount of wages subject to federal and state unemployment taxes was $24,000.Tax rates are as follows:The total amount withheld from employee wages for federal income taxes was $32,000.

Correct Answer:

Verified

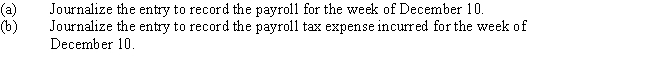

Q167: Journalize the following entries on the books

Q168: Journalize the following entries on the books

Q170: John Woods' weekly gross earnings for the

Q170: An employee earns $40 per hour and

Q171: Excel Products Inc.pays its employees semimonthly.The summary

Q174: On October 1,Ramos Co.signed a $90,000,60-day discounted

Q174: An employee receives an hourly rate of

Q175: List five internal controls that relate directly

Q176: The payroll register of Seaside Architecture Company

Q177: According to a summary of the payroll

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents