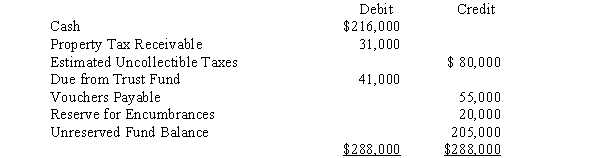

The trial balance for the General Fund of the City of Logan as of December 31,2016,is presented below:

CITY OF LOGAN

The General Fund

Adjusted Trial Balance

December 31,2016

Transactions for the year ended December 31,2017 are summarized as follows:

Transactions for the year ended December 31,2017 are summarized as follows:

1.The City Council adopted a budget for the year with estimated revenue of $720,000 and appropriations of $710,000.

2.Property taxes in the amount of $495,000 were levied for the current year.It is estimated that $20,000 of the taxes levied will prove to be uncollectible.

3.Proceeds from the sale of equipment in the amount of $32,000 were received by the General Fund.The equipment was purchased four years ago with resources of the General Fund at a cost of $200,000.On the date it was purchased,it was estimated that the equipment had a useful life of six years.

4.Licenses and fees in the amount of $90,000 were collected.

5.The total amount of encumbrances against fund resources for the year was $595,000.

6.Vouchers in the amount of $445,000 were authorized for payment.This was $11,000 less than the amount originally encumbered for these purchases.

7.An invoice in the amount of $19,000 was received for goods ordered in 2016.The invoice was approved for payment.

8.Property taxes in the amount of $425,000 were collected.

9.Vouchers in the amount of $385,000 were paid.

10.Forty-one thousand dollars was transferred to the General Fund from the Trust Fund.

11.The City Council authorized the write-off of $15,000 in uncollected property taxes.

Required:

1.Prepare entries,in general journal form,to record the transactions for the year ended December 31,2017.

2.Prepare the necessary closing entries for the year ending December 31,2017.

Correct Answer:

Verified

Q13: Under GASB Statement No. 34, a government-wide

Q14: If a credit was made to the

Q21: The unadjusted trial balance for the general

Q23: The following information regarding the fiscal year

Q25: On December 31,2017,the following account balances,among others,were

Q26: During 2017, the City of Party Beach

Q27: Fund entities may be classified as expendable

Q27: The following account balances,among others,were included in

Q28: Expendable fund entities prepare closing entries at

Q29: At the beginning of 2017, the City

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents