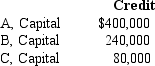

The ABC partnership has the following capital accounts on its books at December 31,2017:  All liabilities have been liquidated and the cash balance is zero.None of the partners have personal assets in excess of his personal liabilities.The partners share profits and losses in the ratio of 3:2:5.If the noncash assets are sold for $400,000,the partners should receive as a final payment:

All liabilities have been liquidated and the cash balance is zero.None of the partners have personal assets in excess of his personal liabilities.The partners share profits and losses in the ratio of 3:2:5.If the noncash assets are sold for $400,000,the partners should receive as a final payment:

A) A,$304,000; B,$176,000; C,$80,000

B) A,$256,000; B,$144,000; C,$-0-

C) A,$304,000; B,$176,000; C,$-0-

D) A,$120,000; B,$80,000; C,$200,000

Correct Answer:

Verified

Q3: Under the Uniform Partnership Act:

A) partnership creditors

Q7: Offsetting a partner's loan balance against his

Q13: The first step in preparing an advance

Q15: The partnership of Mick,Keith,and Charlie has been

Q16: If a partner with a debit capital

Q22: A trial balance for the DEF partnership

Q23: The Uniform Partnership Act specifies specific steps

Q24: Due to the fact that the partnership

Q25: The partnership of Stan,Kenney,and Cartman has been

Q32: A, B, and C have capital balances

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents