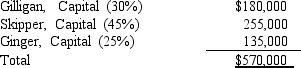

The partnership of Gilligan,Skipper,and Ginger had total capital of $570,000 on December 31,2017 as follows:  Profit and loss sharing percentages are shown in parentheses.Assume that Mary Ann became a partner by investing $150,000 in the Gilligan,Skipper,and Ginger partnership for a 25 percent interest in capital and profits and that partnership net assets are not revalued.Mary Ann's capital credit using the bonus method should be

Profit and loss sharing percentages are shown in parentheses.Assume that Mary Ann became a partner by investing $150,000 in the Gilligan,Skipper,and Ginger partnership for a 25 percent interest in capital and profits and that partnership net assets are not revalued.Mary Ann's capital credit using the bonus method should be

A) $180,000.

B) $142,500.

C) $150,000.

D) $190,000.

Correct Answer:

Verified

Q4: The partnership agreement of Powell, Gaunt, and

Q6: The profit and loss sharing ratio should

Q8: A partnership in which one or more

Q9: When the goodwill method is used to

Q16: Shrek, Donkey, and Muffin are partners with

Q17: Which of the following is an advantage

Q19: The following balance sheet information is for

Q20: Pink desires to purchase a one-fourth capital

Q34: Mack and Ruben are partners operating an

Q37: Carter and Gore are partners in an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents