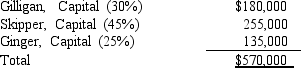

The partnership of Gilligan,Skipper,and Ginger had total capital of $570,000 on December 31,2017 as follows:  Profit and loss sharing percentages are shown in parentheses.

Profit and loss sharing percentages are shown in parentheses.

Assume that Professor became a partner by investing $190,000 in the Gilligan,Skipper,and Ginger partnership for a 25 percent interest in the capital and profits,and the partnership assets are revalued.Under this assumption

A) Professor's capital credit will be $150,000.

B) Gilligan's capital will be increased to $147,000.

C) total partnership capital after Professor's admission to the partnership will be $600,000.

D) net assets of the partnership will increase by $190,000,including Professor's interest.

Correct Answer:

Verified

Q2: Bob and Fred form a partnership and

Q3: In a partnership, interest on capital investment

Q6: The partnership of Abel and Caine was

Q6: The profit and loss sharing ratio should

Q7: At December 31, 2017, Mick and Keith

Q9: The partnership of Gilligan,Skipper,and Ginger had total

Q11: The bonus and goodwill methods of recording

Q13: In the absence of an agreement among

Q17: Which of the following is an advantage

Q18: When the goodwill method is used and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents