The partnership agreement of Sleeter,Frisco,and Kinney provides for annual distribution of profit and loss in the following sequence:

- Frisco,the managing partner,receives a bonus of 10% of net income.

- Each partner receives 5% interest on average capital investment.

- Residual profit or loss is to be divided 4:2:4.

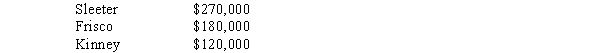

Average capital investments for 2017 were:

Required:

Required:

A.Prepare a schedule to allocate net income,assuming operations for the year resulted in:

1.Net income of $75,000.

2.Net income of $15,000.

3.Net loss of $30,000.

B.Prepare the journal entry to close the Income Summary account for each situation above.

Correct Answer:

Verified

Q23: Agler, Bates and Colter are partners who

Q24: Letterman and Conan are partners who share

Q25: Robbie and Ruben are partners operating a

Q26: Joey and Rachel are partners whose capital

Q29: The partnership of Gamma,Ginger,and Gert had total

Q30: Dante,Milton,and Cervantes formed a partnership and agreed

Q32: The principal types of partnerships are general

Q34: The following balance sheet information is for

Q35: The partners in the ABC partnership have

Q37: The partnership of Ned,Fred,and Ted had total

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents