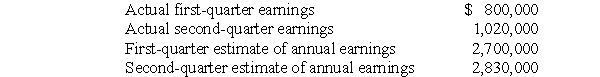

Itchy Company's actual earnings for the first two quarters of 2017 and its estimate during each quarter of its annual earnings are:

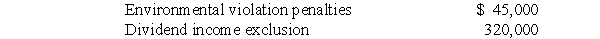

Itchy Company estimated its permanent differences between accounting income and taxable income for 2017 as:

Itchy Company estimated its permanent differences between accounting income and taxable income for 2017 as:

These estimates did not change during the second quarter.The combined state and federal tax rate for Itchy Company for 2017 is 40%.

These estimates did not change during the second quarter.The combined state and federal tax rate for Itchy Company for 2017 is 40%.

Required:

Prepare journal entries to record Itchy Company's provisions for income taxes for each of the first two quarters of 2017.

Correct Answer:

Verified

Q22: In SFAS No. 131, the FASB requires

Q29: For interim financial reporting, a company's income

Q30: If annual major repairs made in the

Q33: The computation of a company's third quarter

Q34: An inventory loss from a market price

Q34: Walleye Industries operates in four different industries.Information

Q38: During the second quarter of 2017, Clearwater

Q41: Blink Company,which uses the FIFO inventory method,had

Q42: Morgan Company prepares quarterly financial statements.The following

Q44: XYZ Corporation has eight industry segments with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents