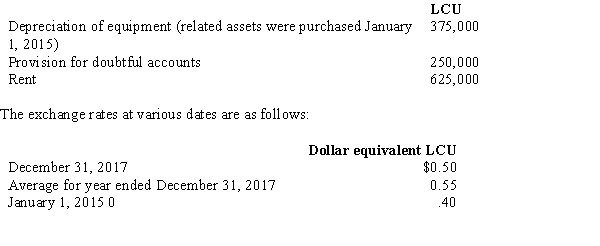

A wholly owned subsidiary of a U.S.parent company has certain expense accounts for the year ended December 31,2017,stated in local currency units (LCU) as follows:  Assume that the LCU is the subsidiary's functional currency and that the charges to the expense accounts occurred approximately evenly during the year.What total dollar amount should be included in the translated income statement to reflect these expenses?

Assume that the LCU is the subsidiary's functional currency and that the charges to the expense accounts occurred approximately evenly during the year.What total dollar amount should be included in the translated income statement to reflect these expenses?

A) $687,500

B) $625,000

C) $550,000

D) $500,000

Correct Answer:

Verified

Q3: In preparing consolidated financial statements of a

Q4: Average exchange rates are used to translate

Q6: The process of translating the accounts of

Q8: The objective of remeasurement is to:

A) produce

Q10: P Company acquired 90% of the outstanding

Q13: Assuming no significant inflation, gains resulting from

Q14: Gains from remeasuring a foreign subsidiary's financial

Q16: The translation adjustment that results from translating

Q19: Under the temporal method, monetary assets and

Q20: The appropriate exchange rate for translating a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents