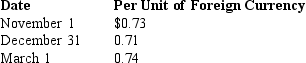

On November 1,2017,American Company sold inventory to a foreign customer.The account will be settled on March 1 with the receipt of $500,000 foreign currency units (FCU) .On November 1,American also entered into a forward contract to hedge the exposed asset.The forward rate is $0.70 per unit of foreign currency.American has a December 31 fiscal year-end.Spot rates on relevant dates were:  The entry to record the forward contract is

The entry to record the forward contract is

A) FCU Receivable,350,000; Premium on Forward Contract,15,000; Dollars Payable,365,000

B) Dollars Receivable,365,000; Discount on Forward Contract,15,000; FCU Payable,350,000

C) FCU Receivable,365,000; Discount on Forward Contract,15,000; Dollars Payable,350,000

D) Dollars Receivable,350,000; Discount on Forward Contract,15,000; FCU Payable,365,000

Correct Answer:

Verified

Q1: The forward exchange rate quoted for the

Q5: On September 1,2017,Mudd Plating Company entered into

Q6: The discount or premium on a forward

Q7: On November 1,2017,American Company sold inventory to

Q7: A transaction loss would result from:

A) an

Q8: From the viewpoint of a U.S. company,

Q11: A discount or premium on a forward

Q13: The exchange rate quoted for future delivery

Q17: A transaction gain or loss on a

Q20: A transaction gain is recorded when there

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents