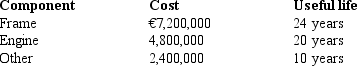

On January 1,2016,BelgianAir purchases an airplane for €14,400,000.The components of the airplane and their useful lives are as follows:  BelgianAir uses the straight-line method of depreciation.The asset is assumed to have no salvage value.

BelgianAir uses the straight-line method of depreciation.The asset is assumed to have no salvage value.

Under IFRS,the entry to record the acquisition of the airplane would include

A) a debit to Asset/ Airplane of €14,400,000.

B) a debit to Asset/ Airplane frame of €14,400,000.

C) a debit to Asset/ Airplane engine of €4,800,000.

D) cannot be determined from the information given.

Correct Answer:

Verified

Q1: SFAS No.162, the Accounting Standards Codification, is

Q2: In accounting for liabilities, IFRS interprets "probable"

Q7: The major difference between IFRS and US

Q10: One difference between IFRS and GAAP in

Q11: Accounting under IFRS and US GAAP is

Q12: The amount of a long-lived asset impairment

Q16: Which statement below concerning the accountability and

Q19: On January 1,2016,BelgianAir purchases an airplane for

Q22: Bruges Electronics Inc. offers one model of

Q25: Under IFRS, the criteria to determine whether

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents