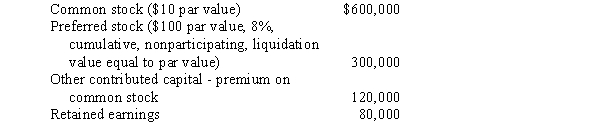

On January 1,2016,Prosser Company acquired 90% of the common stock of Simone Company for $720,000 and 20% of the preferred stock for $70,000.On this date,Simone Company reported the following account balances:

Simone Company did not declare a cash dividend during 2015.Prosser Company uses the cost method.

Simone Company did not declare a cash dividend during 2015.Prosser Company uses the cost method.

Required:

A.During 2016 Simone Company reported net income of $360,000 and declared cash dividends of $160,000.Calculate the 2016 noncontrolling interest in net income and the amount of the cash dividends Prosser Company should have received during the year from each of the stock investments.

B.Prepare,in general journal form,the workpaper entries that would be made in the preparation of the December 31,2016,consolidated statements workpaper.The difference between the implied value of the common stock and the book value interest acquired is attributable to an undervaluation in the land of Simone Company.Any difference between the implied value of the preferred stock and its book value is allocated to other contributed capital.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q21: On January 2, 2016, Porous, Inc. acquired

Q24: Pentagon Company acquired 90% of Smoker Company's

Q25: Parker Company owns 90% of the outstanding

Q27: Parker Company owns 90% of the outstanding

Q28: Parker Company owns 90% of the outstanding

Q28: Pratt Company,who owns an 80% interest in

Q29: On January 1, 2016, Power Company purchased

Q29: On January 1,2016,Pippert Company acquired 80% of

Q30: On January 2,2016,Palomine Corporation purchased 80% of

Q31: On January 1,2016,Pultey Company acquired an 80%

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents