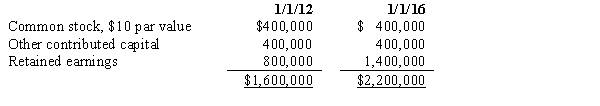

On January 1,2012,Parent Company purchased 32,000 of the 40,000 outstanding common shares of Sub Company for $1,520,000.On January 1,2016,Parent Company sold 4,000 of its shares of Sub Company on the open market for $90 per share.Sub Company's stockholders' equity on January 1,2012,and January 1,2016,was as follows:  The difference between implied and book value is assigned to Sub Company's land.The amount of the gain on sale of the 4,000 shares that should be recorded on the books of Parent Company is:

The difference between implied and book value is assigned to Sub Company's land.The amount of the gain on sale of the 4,000 shares that should be recorded on the books of Parent Company is:

A) $68,000.

B) $170,000.

C) $96,000.

D) $200,000.

Correct Answer:

Verified

Q1: Parr Company owned 24,000 of the 30,000

Q3: On January 1,2012,Pine Corporation purchased 24,000 of

Q5: On January 1,2012,Pharma Company purchased 16,000 of

Q6: Under the partial equity method, the workpaper

Q7: When the parent company sells a portion

Q8: P Corporation purchased an 80% interest in

Q8: Parr Company owned 24,000 of the 30,000

Q15: On January 1 2016, Pounder Company purchased

Q18: On January 1 2016, Paulus Company purchased

Q20: The computation of noncontrolling interest in net

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents