On January 1,2017,Perch Company purchased an 80% interest in the capital stock of Salmon Company for $3,400,000.At that time,Salmon Company had common stock of $2,200,000 and retained earnings of $620,000.Perch Company uses the cost method to record its investment in Salmon Company.Differences between the fair value and the book value of the identifiable assets of Salmon Company were as follows:

The book values of all other assets and liabilities of Salmon Company were equal to their fair values on January 1,2017.The equipment had a remaining life of five years on January 1,2017; the inventory was sold in 2017.

The book values of all other assets and liabilities of Salmon Company were equal to their fair values on January 1,2017.The equipment had a remaining life of five years on January 1,2017; the inventory was sold in 2017.

Salmon Company's net income and dividends declared in 2017 were as follows:

Year 2017 Net Income of $400,000; Dividends Declared of $100,000

Required:

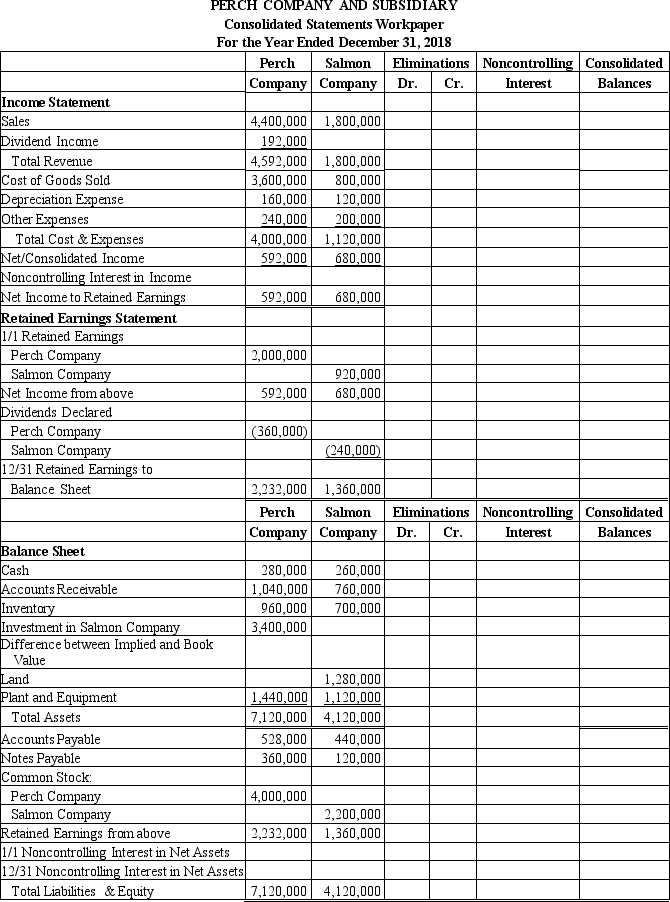

Prepare a consolidated statements workpaper for the year ended December 31,2018 using the partially completed worksheet.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: The workpaper entry in the year of

Q20: P Company owns an 80% interest in

Q21: P Company owns an 80% interest in

Q25: P Company regularly sells merchandise to its

Q27: On January 1,2017,Pharma Company purchased a 90%

Q28: P Company owns an 80% interest in

Q29: Determination of the noncontrolling interest in consolidated

Q29: Pine Company owns an 80% interest in

Q30: P Corporation acquired a 60% interest in

Q31: Past and proposed GAAP agree that unrealized

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents