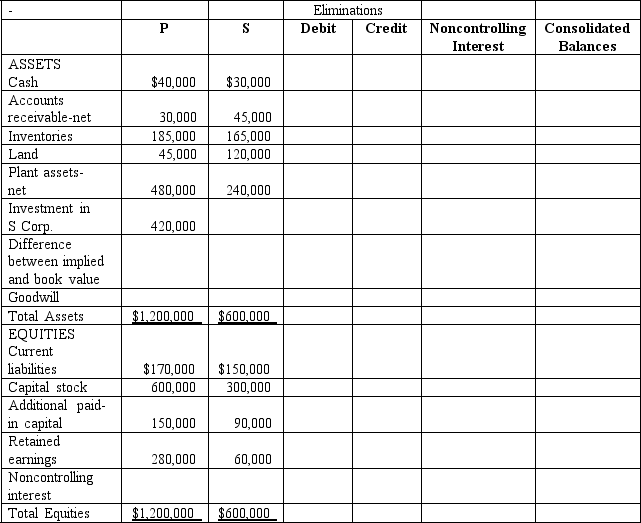

P Corporation paid $420,000 for 70% of S Corporation's $10 par common stock on December 31,2016,when S Corporation's stockholders' equity was made up of $300,000 of Common Stock,$90,000 of Other Contributed Capital and $60,000 of Retained Earnings.S's identifiable assets and liabilities reflected their fair values on December 31,2016,except for S's inventory which was undervalued by $60,000 and their land which was undervalued by $25,000.Balance sheets for P and S immediately after the business combination are presented in the partially completed work-paper below.

Required:

Required:

Complete the consolidated balance sheet workpaper for P Corporation and Subsidiary.

Correct Answer:

Verified

Q25: If an entity is not considered a

Q27: P Company acquired 54,000 shares of the

Q29: On January 1,2016,Prima Company issued 1,500 of

Q30: On January 1,2016,Pent Company and Shelter Company

Q31: On December 31,2016,Priestly Company purchased a controlling

Q31: IFRS defines control as:

A) the direct or

Q32: On January 1,2016,Pent Company and Shelter Company

Q35: A useful first step in the consolidating

Q35: Prepare in general journal form the workpaper

Q37: On January 1,2016,Pent Company and Shelter Company

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents