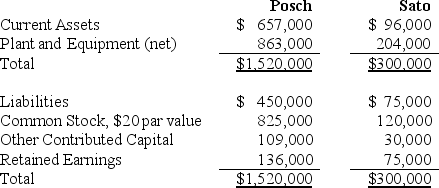

Posch Company issued 12,000 shares of its $20 par value common stock for the net assets of Sato Company in a business combination under which Sato Company will be merged into Posch Company.On the date of the combination,Posch Company common stock had a fair value of $30 per share.Balance sheets for Posch Company and Sato Company immediately prior to the combination were as follows:  If the business combination is treated as an acquisition and the fair value of Sato Company's current assets is $135,000,its plant and equipment is $363,000,and its liabilities are $84,000,Posch Company's financial statements immediately after the combination will include:

If the business combination is treated as an acquisition and the fair value of Sato Company's current assets is $135,000,its plant and equipment is $363,000,and its liabilities are $84,000,Posch Company's financial statements immediately after the combination will include:

A) Negative goodwill of $54,000.

B) Plant and equipment of $1,226,000.

C) Plant and equipment of $1,172,000.

D) An extraordinary gain of $54,000.

Correct Answer:

Verified

Q3: Under the acquisition method, if the fair

Q7: If the value implied by the purchase

Q11: SFAS 141R requires that all business combinations

Q14: In a leveraged buyout, the portion of

Q15: When the acquisition price of an acquired

Q24: Balance sheet information for Hope Corporation at

Q25: North Company issued 24,000 shares of its

Q33: The fair value of net identifiable assets

Q35: SFAS No. 142 requires that goodwill impairment

Q40: P Company acquires all of the voting

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents