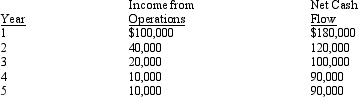

The management of Dakota Corporation is considering the purchase of a new machine costing $420,000. The company's desired rate of return is 10%. The present value factors for $1 at compound interest of 10% for 1 through 5 years are 0.909, 0.826, 0.751, 0.683, and 0.621, respectively. In addition to the foregoing information, use the following data in determining the acceptability in this situation:  The present value index for this investment is:

The present value index for this investment is:

A) 1.08

B) 1.45

C) 1.14

D) .70

Correct Answer:

Verified

Q106: Using the following partial table of present

Q107: Below is a table for the present

Q108: The management of Zesty Corporation is considering

Q110: The management of Indiana Corporation is considering

Q112: The expected average rate of return for

Q113: Which of the following is not an

Q113: The rate of earnings is 10% and

Q114: The management of River Corporation is considering

Q115: The management of Idaho Corporation is considering

Q116: An anticipated purchase of equipment for $600,000,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents