A project has estimated annual cash flows of $95,000 for four years and is estimated to cost $260,000. Assume a minimum acceptable rate of return of 10%. Using the following tables determine the (a) net present value of the project and (b) the present value index, rounded to two decimal places.

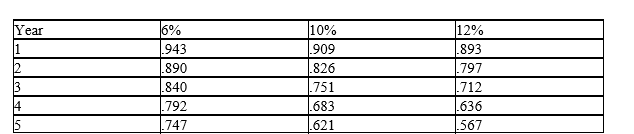

Below is a table for the present value of $1 at compound interest.

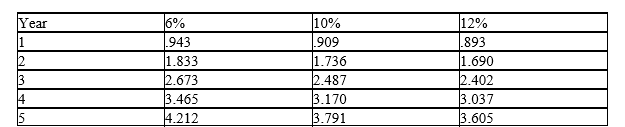

Below is a table for the present value of an annuity of $1 at compound interest.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q140: The production department is proposing the purchase

Q141: Norton Company is considering a project that

Q143: A project is estimated to cost $273,840

Q145: A project has estimated annual net cash

Q149: An 6-year project is estimated to cost

Q152: The process by which management allocates available

Q154: Determine the average rate of return for

Q155: An 8-year project is estimated to cost

Q160: A company is contemplating investing in a

Q174: Determine the average rate of return for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents