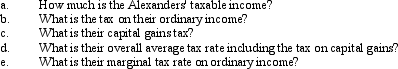

The following is a listing of tax considerations for John and Jane Alexander, who file jointly and have two children.

Assume the following hypothetical tax table:

The personal exemption rate is $3,050

The long-term capital gains rate for this family is 18%.

Correct Answer:

Verified

Q123: During the past year, Albert Corporation had

Q131: The tax treatment of capital gains is

Q133: A company has a loss of $15,000

Q138: Leverage means using borrowed money to enhance

Q140: In the corporate tax system, higher-income taxpayers

Q142: Red and Blue have EBIT of $20.0M

Q144: The Smith family has the following

Q145: XYZ Inc. has taxable income of $14,000,000

Q146: A family has taxable income of $150,000.

Q147: What is the corporate tax paid

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents