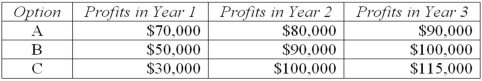

You have just been hired as a consultant to help a firm to decide which of three options to take to maximize the value of the firm over the next three years. The following table shows year-end profits for each option. Interest rates are expected to be stable at 8 percent over the next three years.  a. Discuss the difference in the profits associated with each option. Provide an example of real-world options that might generate such profit streams.

a. Discuss the difference in the profits associated with each option. Provide an example of real-world options that might generate such profit streams.

b. Which option has the greatest present value?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q122: You are the manager of a Fortune

Q124: A bond pays $100 at the end

Q126: Suppose the growth rate of the firm's

Q128: Suppose total benefits and total costs are

Q130: You are the manager of a firm

Q132: You are the manager of a firm

Q134: Your firm's research department has estimated your

Q137: Suppose total benefits and total costs are

Q140: Delta Software earned $10 million this year.Suppose

Q141: You are a strong advocate for a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents