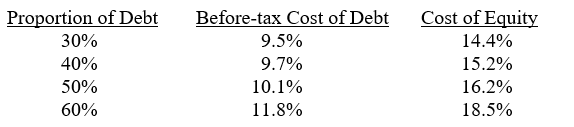

Takeoka's Sushi To Go has estimated the following cost of debt before-tax) and cost of equity.

What is the cost of capital at Takeoka's optimal capital structure given the above information and a 40% effective tax rate?

A) 10.78%

B) 11.02%

C) 11.13%

D) 11.45%

Correct Answer:

Verified

Q14: An optimal capital structure minimizes a firm's

Q15: How does high business risk affect firm

Q16: Bankruptcy costs are one type of financial

Q17: A firm's capital structure is its proportion

Q18: A firm's use of more debt financing

Q19: Financial risk is the basic risk inherent

Q20: The desire to maintain high bond ratings

Q21: An investment banking firm has estimated the

Q22: An investment banking firm has estimated the

Q24: Luther's Famous Barbeque has estimated the following

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents