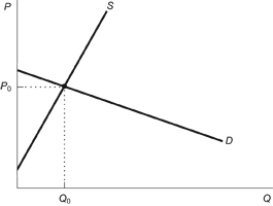

Figure: Commodity Tax with Elastic Demand  According to the figure, who bears the greater burden of a commodity tax?

According to the figure, who bears the greater burden of a commodity tax?

A) The buyer will bear the greater burden of the tax.

B) The seller will bear the greater burden of the tax.

C) The buyer and the seller will split the tax burden equally.

D) The government will bear the full burden of the tax.

Correct Answer:

Verified

Q36: With a tax on consumers, supply:

A) increases.

B)

Q37: Use the following to answer questions:

Figure: Tax

Q38: Suppose there is a tax of $50

Q39: If buyers are required to pay a

Q40: Use the following to answer questions:

Figure: Demand

Q42: Use the following to answer questions:

Figure: Tax

Q43: If consumers pay 100 percent of a

Q44: Suppose that there is a tax of

Q45: In the market for Good X-a necessity

Q46: Whether a buyer or a seller pays

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents