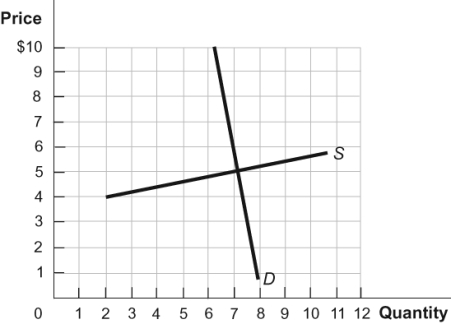

Figure: Supply and Demand  If the government places a tax on sellers of $0.67 per unit in this market, who will bear the burden of the tax?

If the government places a tax on sellers of $0.67 per unit in this market, who will bear the burden of the tax?

A) Sellers will pay 100 percent of the tax in the form of lower prices.

B) The tax will be split 50-50 between sellers and buyers.

C) Buyers will pay the majority of the tax.

D) Sellers will pay the majority of the tax.

Correct Answer:

Verified

Q57: Suppose that sellers require $6.70 per unit

Q58: Figure: Elasticities of Supply and Demand

Q59: Use the following to answer questions:

Figure: Tax

Q60: Use the following to answer questions:

Figure: Tax

Q61: In the eighteenth century, the British Crown

Q63: If the District of Columbia decided to

Q64: On June 23, 2011, Honduras announced new

Q65: Figure: Commodity Tax with Elastic Supply

Q66: If the elasticity of supply is 1,

Q67: Consider the market for gasoline, a good

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents