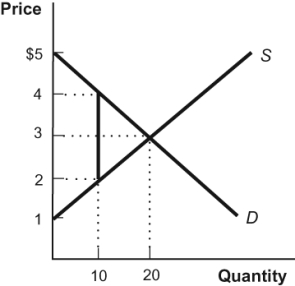

Figure: Tax

Refer to figure. After instituting a $2 tax on the market in this figure, calculate the loss in consumer surplus, the loss in producer surplus, the government's revenue from the tax, and the area of deadweight loss.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q213: With a subsidy, the price paid by

Q214: Ceteris paribus, the more elastic the supply

Q215: When the federal government provided a subsidy

Q216: Subsidies lead to the existence of nonbeneficial

Q217: Taxes reduce the gains from trade, despite

Q219: According to Nobel Laureate Edmund Phelps, minimum

Q220: Using demand and supply diagrams show the

Q221: A market is described by the equations

Q222: A labor market is described by two

Q223: A market is described by the equations

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents